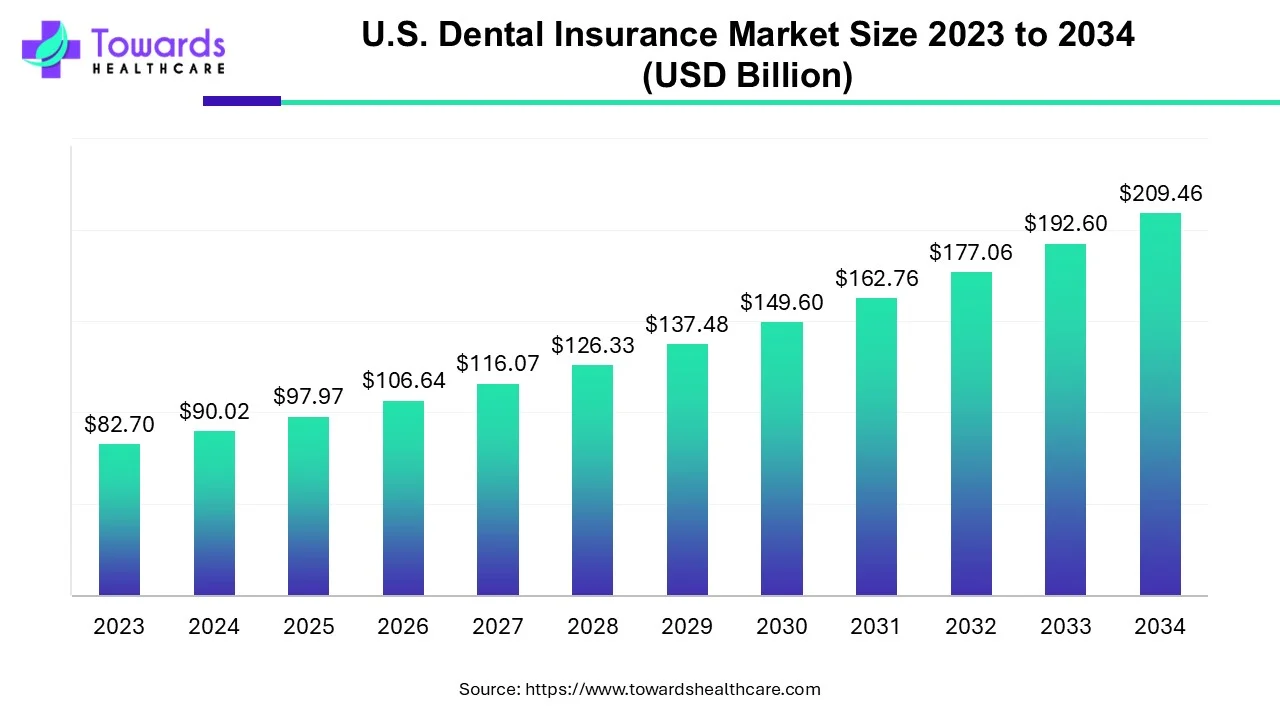

U.S. Dental Insurance Market Size Expected to Reach USD 209.46 Bn by 2034

The U.S. dental insurance market to grow from USD 97.97 billion in 2025 and is expected to expand USD 209.46 billion by 2034, representing a compound annual growth rate (CAGR) of 8.84% over the forecast period.

Ottawa, Aug. 26, 2025 (GLOBE NEWSWIRE) -- The U.S. dental insurance market was valued at USD 90.02 billion in 2024 and is projected to reach approximately USD 209.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.84%, according to a study by Towards Healthcare, a sister firm of Precedence Research.

Widespread favorable government policies, and a rise in dental disorders & technological developments are propelling the global market expansion.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5472

Key Takeaways

- By coverage, the dental preferred provider organizations (DPPO) segment led the market in 2024.

- By coverage, the dental health maintenance organizations (DHMO) segment is expected to grow significantly during 2025-2034.

- By type, the preventive segment dominated the U.S. dental insurance market in 2024.

- By type, the basic segment is expected to register notable expansion in the upcoming years.

- By demographic, the senior citizens segment held the biggest revenue share of the market in 2024.

- By demographic, the adult segment is expected to grow at a significant CAGR during 2025-2034.

Market Overview & Potential

The U.S. dental insurance market encompasses specialized health policies, which offer coverage for oral care expenses, including checkups, fillings, extractions, and dentures, typically with annual coverage limits. Nowadays, the market is embracing novel technologies, such as tele-dentistry, enhanced adoption of AI in diverse aspects of dental care, and the continued integration of 3D printing for tailored solutions. Along with this, the market is looking for expansion in robotic-driven procedures and an increased focus on patient experience, like emotional dentistry.

What are the Key Growth Drivers Involved in the Expansion of the Market?

The U.S. dental insurance market is driven by a rise in efforts towards preventive care to cover with no deductible or waiting period. This also includes routine cleanings for people and fluoride treatments for those under the age of 16. On the other hand, wider demand for aesthetic dentistry, a geriatric population, and the need for more accessible and cost-effective care are fueling the overall development and adoption of dental insurance to assist protection of numerous smiles.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Key Trends Involved in the Market?

Ongoing investments in dental care in the US and advanced technologies are highly impacting the growth of the U.S. dental insurance market.

- In July 2025, New York-based healthcare investment firm OrbiMed invested a total of $85 million in Swiss company vVARDIS, known for its drill-free treatment for early tooth decay.

- In March 2025, Sun Life U.S. and DentaQuest, part of its Dental business, partnered with TeamSmile with $825,000 donation, extending the nationwide dental home project.

- In March 2024, Overjet, the world-leader in dental AI, raised a $53.2 million Series C round in artificial intelligence for dentistry.

What is the Major Challenge in the Market?

The U.S. dental insurance market is facing certain limitations, including a lack of coverage provided by basic plans, which usually include implants, orthodontics, or cosmetic treatments, discouraging consumers from purchasing insurance. As well as a key challenge for low-income families and individuals is the expense of dental insurance in the US.

Country-level Analysis

In the U.S., enhancement in healthcare technologies, including development in dental care. Mainly, the U.S. dental insurance market is embracing innovative techniques, especially laser dentistry, ozone therapy, and biomimetic dentistry are popular, focusing on preserving natural tooth structure. Alongside significant steps in digital dentistry, including digital impressions, CAD/CAM technology, and 3D printing, are transforming restorations and treatment planning. And, this further demands favourable dental insurance plans for successful dental surgeries. The U.S.’s increasing geriatric population and dental issues are fueling the widespread adoption of remote monitoring, and consultations are expanding access to care, especially for rural populations.

For this market,

- In January 2025, Pearl and Carestream Dental partnered to provide advanced dental AI solutions to providers across North America.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Segmental Insights

By Coverage Analysis

Why did the Dental Preferred Provider Organizations (DPPO) Segment Lead the Market in 2024?

In the U.S. dental insurance market, the dental preferred provider organizations (DPPO) segment held the biggest revenue share in 2024. The flexibility, affordability of DPPO are mainly impacting its overall expansion. This kind of coverage offers a wider dental procedures, from basic cleanings to more extensive treatments, such as fillings, crowns, and root canals. This DPPO covers higher premiums with a network of dentists who have agreed to discounted fees for services.

On the other hand, the dental health maintenance organizations (DHMO) segment is predicted to expand at a notable CAGR in the upcoming years. This segment is driven by the requirement of enrollees to receive care from dentists within their network. Prominent advantages of DHMO are the possession of lower premiums as compared to other dental insurance plans. Apart from this, DHMOs promote regular check-ups and preventive care. Whereas, incorporation of the capitation model, enrollees can often predict their out-of-pocket costs. DHMOs are focusing on a wide range of preventive services like checkups, cleanings, and fluoride treatments to assist in maintaining oral health and potentially avoid more costly procedures.

By Type Analysis

How did the Preventive Segment Hold a Major Share of the Market in 2024?

The preventive segment accounted for the dominating share of the U.S. dental insurance market in 2024. The segment is fueled by increased integration of AI and digital technologies, like AI-enabled smart toothbrushes and oral health apps, to offer real-time feedback and personalized care plans. Additionally, the US encompasses other preventive solutions in dental sensors, especially the use of smart toothbrushes, which employ sensors and AI to track and enhance user brushing techniques. Also, oral health apps are facilitating customized plans, appointment reminders, and virtual consultations.

Whereas, the basic segment is anticipated to expand significantly during 2025-2034. It mainly comprises breakthroughs in minimally invasive techniques, digital technologies, and optimized materials. Inclusion of laser dentistry, CAD/CAM technology for restorations, and tele-dentistry for remote consultations are boosting the overall market development. The adoption of laser dentistry in numerous procedures, like cavity preparation, gum contouring, and treating periodontal disease, offers less invasive and more accurate treatment with rapid healing. This ultimately demands adaptable dental insurance plans.

By Demographic Analysis

What Made the Senior Citizens Segment Dominate the Market in 2024?

In 2024, the senior citizens segment led with the largest revenue share of the U.S. dental insurance market. The growing tooth loss concerns in senior citizens are further facing a decline in edentulism (having no teeth). For these issues, a widespread aged Americans rely on the acquisition of their natural teeth with excellent preventive care and better preventative care and treatments for gum disease and dental caries. Moreover, ongoing developments in dental implants, materials science, and diagnostic technologies are also reshaping senior dental care.

However, the adult segment is anticipated to witness a notable growth during 2025-2034. The increasing tooth loss, need for root canals are highly propelling the segment growth. This further extends to the adoption of novel techniques, such as flapless surgery and immediate implant loading are well-known, resulting in less tissue trauma, reduced pain, and faster recovery. Alongside, the demand for minimally invasive procedures consisting of silver diamine fluoride, which supports root caries, particularly for homebound or institutionalized older adults.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Recent Developments

- In July 2025, RipeGlobal introduced an AI-powered dental training platform in the U.S. market.

- In June 2025, Owandy Radiology Inc., a global player in the manufacture of dental radiology hardware and imaging software, launched its new Oral Health Report application, a cutting-edge addition to its IOS software suite.

- In October 2024, Renaissance Life & Health Insurance Company of America launched a new technology initiative called RenConnect℠ to expand efficiency and ease of doing business for its customers.

- In April 2024, Zentist launched Cavi AR, an RCM Software for dental insurance AR & claims management.

Key Players List

- Aetna

- AFLAC, Inc.

- Ameritas

- Cigna Healthcare

- Delta Dental

- Humana

- Metlife Services & Solutions LLC

- Renaissance Dental

- Spirit Dental Insurance

- The Guardian Life Insurance Company of America

- United Concordia

- United Healthcare, Inc.

Browse More Insights of Towards Healthcare:

The global clear aligners market was valued at USD 6.51 billion in 2024, grew to USD 8.55 billion in 2025, and is projected to reach approximately USD 99.44 billion by 2034, expanding at a CAGR of 31.34% between 2025 and 2034.

The global dental tourism market is estimated at USD 8.55 billion in 2024, increasing to USD 10.43 billion in 2025, and is expected to reach around USD 62.65 billion by 2034, growing at a CAGR of 22.04% over the forecast period.

The U.S. dental services organization (DSO) market was valued at USD 37.9 billion in 2024, rose to USD 44.7 billion in 2025, and is projected to reach approximately USD 196.5 billion by 2034, at a CAGR of 17.9%.

The global dental services organization market stood at USD 163.93 billion in 2024, increased to USD 192.83 billion in 2025, and is expected to reach around USD 835.87 billion by 2034, expanding at a CAGR of 17.65% between 2025 and 2034.

The global dental equipment market was valued at USD 11.95 billion in 2024, reached USD 12.71 billion in 2025, and is projected to grow to approximately USD 22.1 billion by 2034, at a CAGR of 6.34%.

The global dental services market is expected to grow from USD 499.21 billion in 2025 to USD 769.8 billion by 2034, reflecting a CAGR of 4.93% during the forecast period.

The global dental consumables market was estimated at USD 40.7 billion in 2024, is projected to reach USD 42.92 billion in 2025, and is expected to grow to around USD 69.23 billion by 2034, expanding at a CAGR of 5.46%.

The global dental imaging market was valued at USD 3.12 billion in 2024 and is forecast to grow steadily to USD 3.35 billion in 2025 and USD 6.42 billion by 2034, at a CAGR of 7.46%.

Segments Covered in The Report

By Coverage

- Dental Preferred Provider Organizations (DPPO)

- Dental Health Maintenance Organizations (DHMO)

- Dental Indemnity Plans

- Others

By Type

- Preventive

- Basic

- Major

By Demographic

- Senior Citizens

- Adults

- Minors

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5472

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.